The pandemic has upended the travel industry more than any other industry. Today, the face of meetings has changed. In the past two years with the rise and use of Zoom, Teams, Webex and other connectivity tools, the way we conduct business and meet people looks very different than the pre-Covid days. As organizations and people turn to a hybrid or online only solution, the industry is at crossroads. In 2021, the industry had some reasons for optimism. The travel and hospitality industry saw some signs of recovery, led by a tremendous surge in domestic leisure travel. According to U.S. Travel Association and Tourism Economics[1], domestic leisure travel will surpass pre-Covid numbers. However, business travel recovery will not happen until 2024.

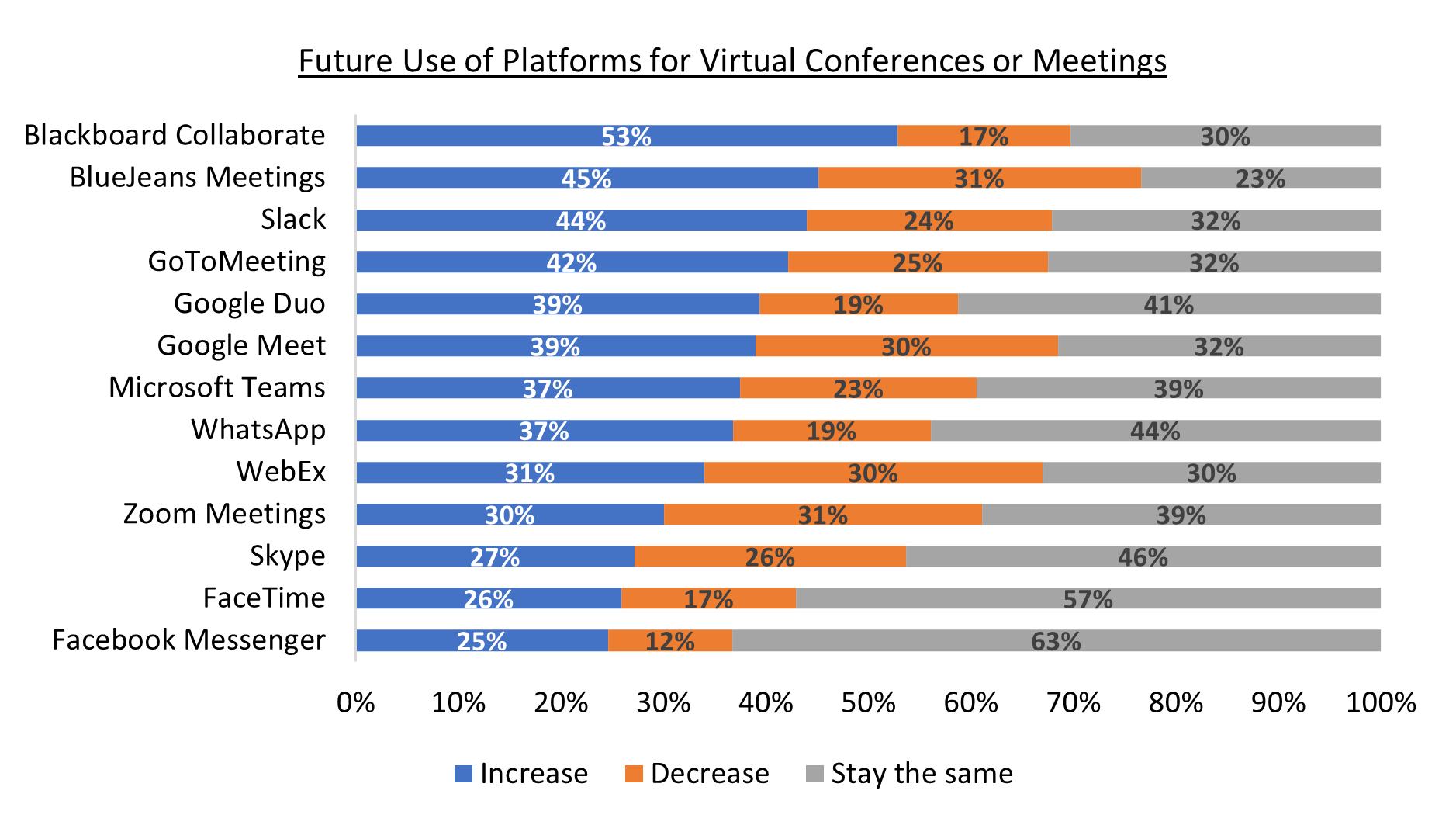

Last year saw face to face meetings replaced with virtual meetings and a return to the office on a permanent basis a distant reality. According to the latest U.S. National Technology Readiness Survey (NTRS) results released by Rockbridge in 2021, consumers cited using Zoom meetings (23%), Microsoft Teams (17%), Google Meet (13%) and Blackboard Collaborate (12%) as tools they have used at work in the past 12 months. Younger workers (18-34 years) are more likely than older workers to rely on platforms and tools for business. A majority of individuals will increase or continue at the same rate of usage virtual meeting platforms and tools once the pandemic ends. Most of the increase in future usage will be driven by younger workers (18-34 years of age).

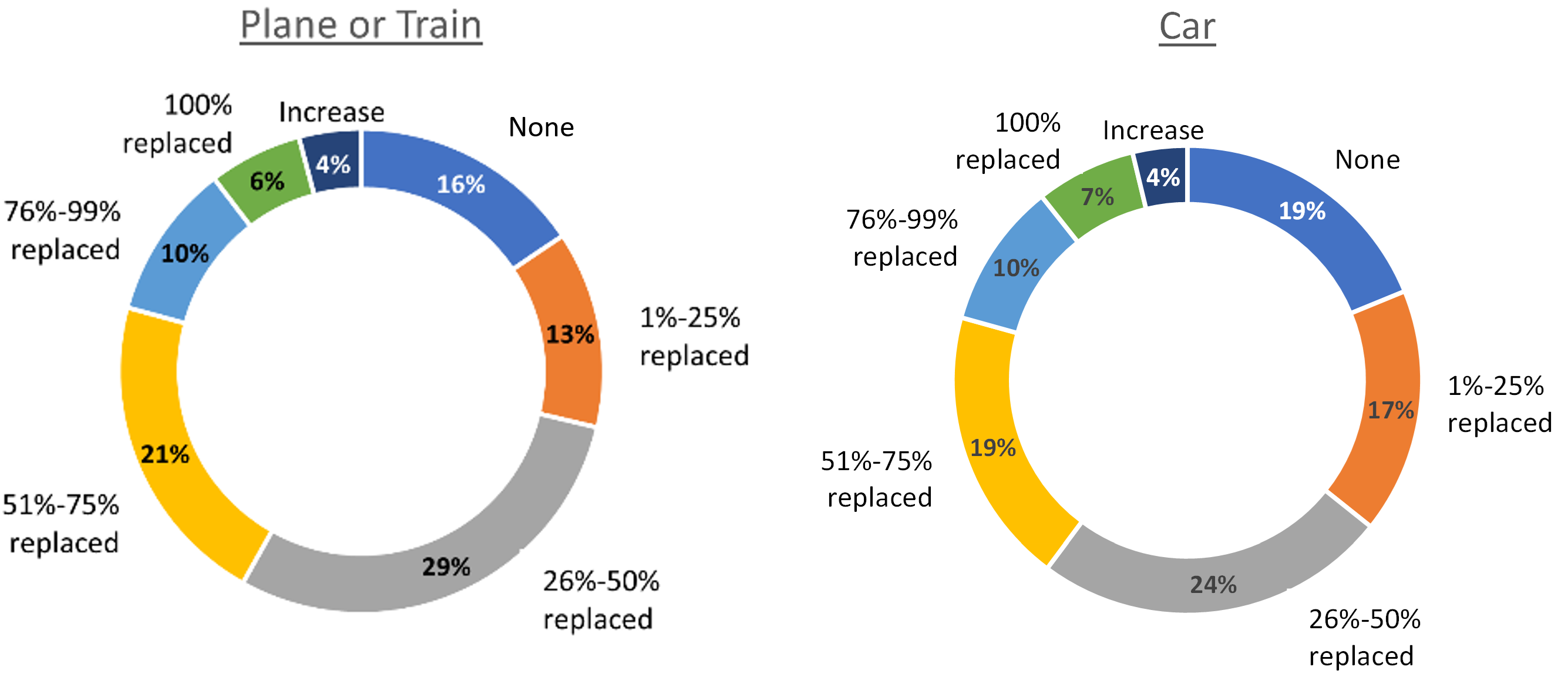

Most business travelers expect a portion of their work-related travel to be replaced by video conferencing in the future. Over a third (37%) of those who travel by plane or train expect that at least 50% of their trips will be replaced while four-in-ten expect 1% to 50% to be replaced. Only a fifth believe there will be no impact, or in the case of a few, that their physical air/rail trips will increase. The impact among business travelers who travel by car report a similar impact, with about a third (36%) expecting at least half of their trips to be replace by video conferencing. There is no doubt that lodging and transportation companies that depend on business travel will be impacted in the future.

Future business travel impact by video conferences and chats

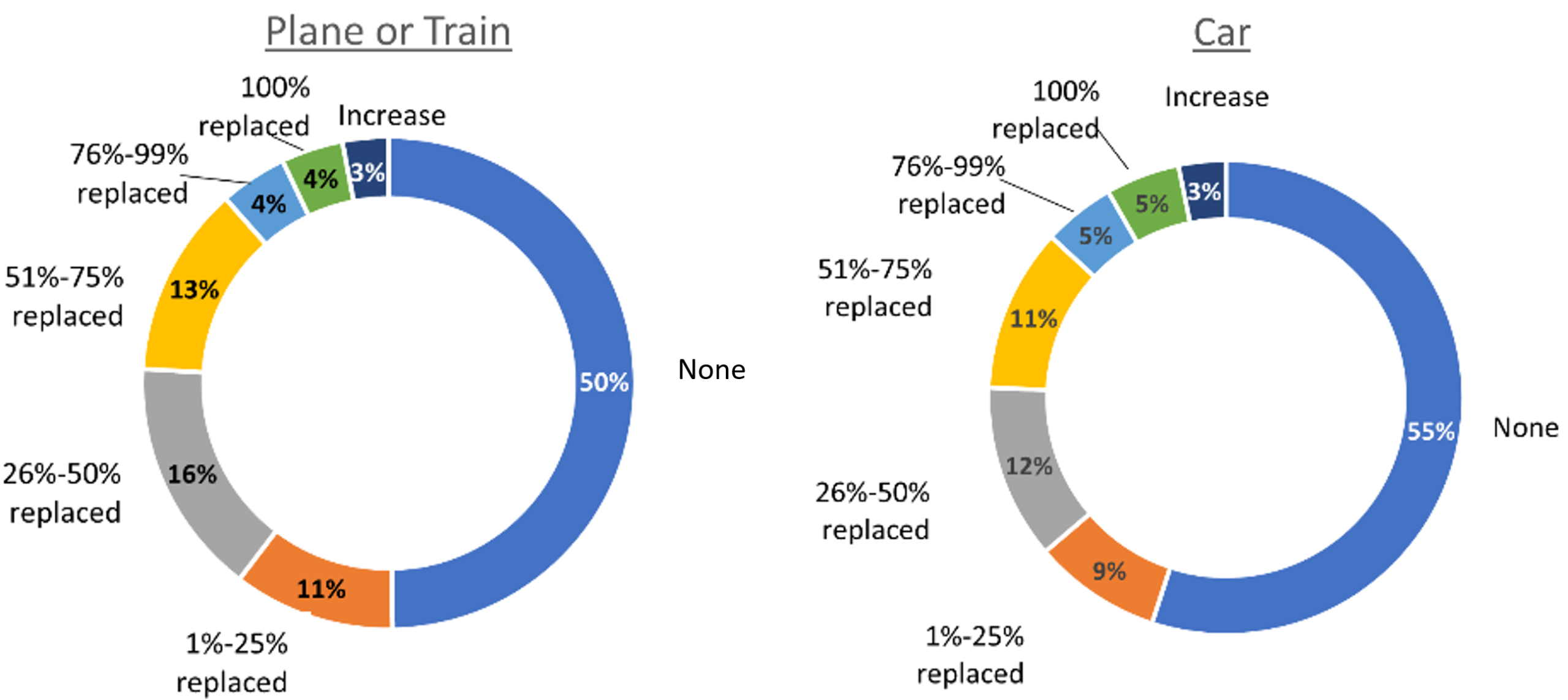

The impact of video conferences and chats on leisure travel will be much smaller than their impact on business travel. About half of leisure travelers expect their travel by plane/train or car to remain the same after the pandemic as before. However, half of leisure travelers expect at least some of their travel to be impacted by video conferencing technology and few believe the technology will result in an increase in travel. If consumer opinions are to be believed, the travel industry needs to be concerned with a loss of leisure business as a well as business.

Future leisure travel impact by video conferences and chats

Based on findings from the NTRS, travel for business and leisure is likely to change by being replaced by video conferences once the pandemic subsides. The top reasons for using video conferences/chats today are: saving money on travel costs (21%), saving time (19%), and having the ability to communicate from anywhere (14%).

While the travel and meetings/events industries have continued to adapt to the changes in consumer expectations by implementing tools and platforms with hybrid meetings or meetings on a small scale, there is also optimism that recovery to pre-pandemic days is likely in 2024, as predicted by industry experts[1]. However, if we take the expectations of travelers at face value, the travel industry should expect challenges in recovering lost business and should be prepared to find creative solutions to ensure physical travel continues to be meaningful.

Learn more about TechQual, our measurement approach to consumer technology adoption.

About the Study: The National Technology Readiness Survey is sponsored by Rockbridge Associates, Inc., A. Parasuraman and the Center for Excellence in Service, Robert H. Smith School of Business, University of Maryland. The study is based on an annual survey of U.S. adults age 18+ sampled from an online panel and weighted based on Census Bureau data. The 2021 study includes 1522 adults and the 2020 study includes 1216 adults. The margin of error is plus or minus 4 percentage points. For more information, contact rockinfo@rockresearch.com.

Written by: Nandini (Nandi) Nadkarni, Senior Research Director