Since 1999, Rockbridge has engaged in a comprehensive research program on technology adoption, collaborating with Prof. A. Parasuraman from the University of Miami. This whitepaper is intended for both practitioners (i.e., Rockbridge clients) and scholars interested in this research. Key topics we address are:

- The Technology Readiness (TR) Construct

- How we measure Technology Readiness, the Technology Readiness Index (TRI)

- The 5 Technology Readiness Segments

- The National Technology Readiness Survey (NTRS)

- When the TRI matters (for managers and researchers)

The construct at the heart of our research is “Technology Readiness” (TR). TR refers to the propensity of an individual to adopt and embrace cutting-edge technology at home and at work. Past research by our team and by other researchers around the world has demonstrated the relevance of the construct in a range of contexts, both among consumers and professionals, in areas including products, services, online government, learning and healthcare. TR is a mindset, not a measure of competence or knowledge. TR has proven to be a stable characteristic that does not change easily for an individual. TR is multifaceted, including two dimensions that are motivators and two that are inhibitors. The specific dimensions include:

Motivators

- Optimism – a general belief that technology and innovation has positive benefits

- Innovativeness – an inherent tendency to want to experiment with, learn about and talk about technology

Inhibitors

- Discomfort – a perceived lack of control over technology

- Insecurity – a belief that technology can result in adverse impacts on the user and society

The dimensions are relatively independent of each other, particularly the positive and negative dimensions. Thus, it is possible, paradoxically, for an individual to simultaneously possess both positive and negative beliefs about technology. The level of technology readiness for an individual is ultimately determined by the balance of positive and negative beliefs, although the particular combinations across the four dimensions has implications for when and how one adopts an innovative product or service.

Technology Readiness is measured with the Technology Readiness Index (TRI), a multi-item scale that has been extensively evaluated for reliability and validity. Work on the TRI started in the late 1990s, including multiple pilot studies in consumer and b2b contexts. The first TRI was published by A. Parasuraman in the Journal of Services Research in 2000. In 2001, Parasuraman and Rockbridge founder Charles Colby published a book on the subject, Techno-Ready Marketing: How and Why Your Customers Adopt Technology. The original TRI scale consisted of 36 questions that were grouped into the four dimensions described above. Recently, Parasuraman and Colby updated and streamlined the index in a multiphase study published in the same journal in 2014. Click here for the abstract. The research process behind this latest version included gathering qualitative insights in a social media forum using OpinionPond™ and a survey of the general population in the U.S. The current index, TRI 2.0, has a more concise set of 16 items and addresses contemporary themes affecting the adoption of cutting edge products and services, such as distraction and becoming socially disconnected. The index provides an overall measure of Technology Readiness, a measure on each of the four technology belief dimensions, and a segmentation classification.

What makes the TRI different from other measures of innovative tendencies? First and foremost, the TRI has been rigorously tested for reliability and validity. In other words, it provides a stable measure that predicts behavior for cutting edge products and services, workplace activities and social media. The measure has been embraced as an important tool for studying technology, and has been used by over 140 scholars in more than 30 countries for scholarly publishing, policy research or dissertations. The instrument has also added value for scores of Rockbridge clients in studies on new products, usability and market segmentation. The TRI is a copyrighted instrument that requires permission to use; scholars interested in using the instrument for studies of a non-commercial nature should contact A. Parasuraman or Rockbridge to request a free academic license. Commercial users and consultants can contact Rockbridge directly about licensing the scale for a fee. The TRI is also unique in its ability to capture multiple facets of belief, providing a more realistic and nuanced view of behavior. For example, instead of viewing adoption as a matter of diffusion to consumers at different stages of a life cycle, the TRI addresses different motivators and inhibitors that would suggest strategies for accelerating adoption of a new product or service.

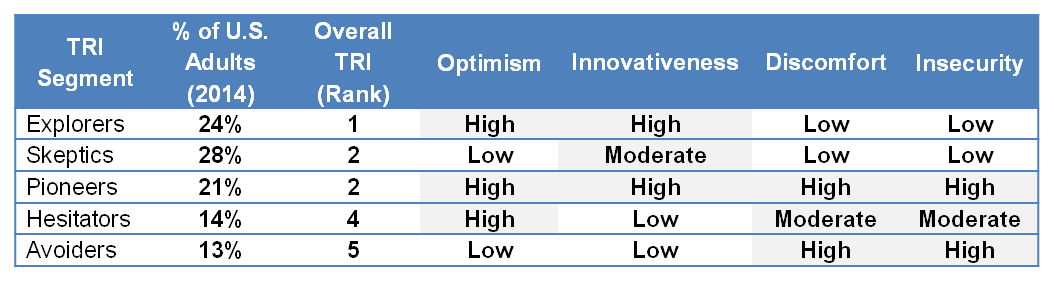

The Technology Readiness Segmentation provides a more holistic view of behavior. The latest research by Rockbridge and Parasuraman introduces a formal segmentation typology that captures different combinations of beliefs. The segmentation implies a differentiated approach for marketing a cutting-edge product or service, while offering researchers a robust tool for describing research subjects. The segments (see table below) include the highly tech-oriented “Explorers”, the strongly engaged “Pioneers”, the dispassionate “Skeptics”, the cautious “Hesitators”, and the tech-resistant “Avoiders”.

We continue to monitor technology beliefs and behavior through the National Technology Readiness Survey (NTRS), an ongoing tracking survey since 1999. The survey is co-sponsored by the Center for Excellence in Service at the Robert H. Smith of Business, University of Maryland, College Park (where Rockbridge is a partner). Each year, the survey gathers normative information on the U.S. population and addresses timely issues faced by services and tech companies. Examples of past topics include the adoption of e-government, the cost of SPAM, the impact of the internet on work habits, green technology, and omni-channel consumer behavior. The Center has publicized the research, and Prof. Parasuraman and Rockbridge staff have presented on the topic at venues such as Frontiers in Services, QUIS, and the Consumer Electronics Show. The NTRS has been replicated in other countries, including Sweden, Norway, Austria and Chile.

The TRI has proven a valuable tool for managers and researchers alike. The scale is used in a wide variety of studies, and includes a 16 question, 10 question and 6 question variation, each capable of providing a segmentation metric.

- What does the TRI tell managers? As outlined in Techno-Ready Marketing and numerous articles and presentations by the authors, the TRI provides a unique lens on the adoption of and satisfaction with cutting edge technology. For instance, it identifies the most techno-ready consumers, who are at the vanguard of adoption and can serve as evangelists for a provider. It also identifies consumers (and business decision-makers) who are enthusiastic about adoption, but who must be given help and reassurance to ensure an innovation moves along the adoption curve. And, the TRI identifies when success depends on making a strong benefits case to buyers who expect proof before they adopt. The association between a buyer/intender’s score on the TRI also provides insight as to whether a product or service is truly an “innovation” that requires marketing in a different fashion than a conventional offering.

- What does the TRI tell scholars? The instrument is used in many studies as an explanatory variable or as a moderator of a behavior, intention or attitude. Papers on the topic have spanned a range of topics, such as mobile services, banking services, travel, e-government, healthcare, rural internet adoption, cross-cultural issues, etc.

- How is the TRI used in Rockbridge engagements? The instrument is included in most engagements involving innovative behavior. Applications include: profiling a market on overall techno-readiness, identifying and profiling the most techno-ready buyers who are critical for communications, assessing the future-potential of an innovation, identifying consumers for usability testing, and providing input for a broader segmentation where technology beliefs are important.

Our research on Technology Readiness is an ongoing endeavor that involves continually learning, updating and refining. The research has provided valuable public information on consumer technology trends, while the TRI has helped countless scholars and managers gain insight into how and why customers adopt technology.